This article is about applications that give personal loans online in Pakistan. Additionally, this information can be helpful for other nations, such as India, Sri Lanka, Nepal, etc. All of the information in this article was verbatim recounted by genuine victims. We will expose the scam used by Pakistani online personal loan applications, and we’ll also go into great depth about how these folks are treated after receiving personal loans. Online Financial Loan Apps Fraud in Pakistan | Exposed Are Loan Apps That Steal Your Data

HOW TO GET A LOAN FROM ONLINE PERSONAL LOAN APPS?

There are several applications that provide customers simple installment Personal Loans in Pakistan and some of its neighbouring nations. Users must complete a few steps and provide their genuine information in accordance with the terms and conditions of the Personal Loan application form in order to get a Personal Loan using these applications. Any loan app will often ask you for various rights after installation, including access to your contact list on your phone and gallery permission, once you’ve entered the necessary information. Apps for online personal loans assert that they simply do this to better serve their customers.

Any kind of forgery is prohibited in lending apps, therefore the data you give must be entirely accurate. Your personal loan application will not be processed if you provide any information on adoption of any kind. As a result, in order to be eligible for a Personal Loan, the information you provide must be accurate.

HOW DID PEOPLE GET CAUGHT BY PERSONAL LOAN-PROVIDING APPS?

Apps for online personal loans exploit regular people in a number of ways. You’ve probably noticed that whenever you go to YouTube to view videos, YouTube normally runs an advertisement first, which sometimes contains adverts for lending applications. Similar adverts may be shown if you use Google to browse a website and attempt to download any app other than those available via the Play Store.

According to the marketing, the business gives you simple payments for a lengthy period of time—say, a month or more up to three months—for a little percentage interest (only 1% to 10%). In other words, the business must pay back the personal loan in the midst of the time it has been given. These businesses, it seems, promote that they provide you between one month and 180 days to pay back the personal loan. Additionally, the Personal Loan has a few percent interest, according to the firm.

However, the business really offers you a personal loan at an interest rate of roughly 20%. Additionally, the Personal Loan payback term is just one week long. The personal loan provider contacts your phone after a week and requests that you repay the personal loan. When you hear this, you can feel overburdened since the business gave you a lot of time before approving the personal loan. However, the truth is the exact reverse. When you tell the corporation what you saw in the commercials, they claim that it is just confined to the ads, but their actual policy is different.

HOW DO PERSONAL LOAN BUSINESSES THREATEN BORROWERS INTO MAKING PAYMENTS ON THEIR LOANS?

Time is out of your control once you are aware of the company’s genuine policy and reality. which a well-known saying is renowned for.

“CRYING OVER spilt milk is pointless”

Now that you have granted the business permission to contact and disrupt a list of all your contacts for Personal Loan repayment after installing the Personal Loan app and before registering for a Personal Loan, the company will begin doing so. starts You are unable to respond since you have now become their victim. At this point, an agreement has been reached between you and the online lending business, according to which, in the event that you are unable to return the whole amount of the Personal Loan, you may pay the firm some of the Personal Loan’s interest via easy money. You send them some of the money now that you are compelled to.

Keep in mind that the sum you will pay is interest on the principal. Your actual funds remain there. This implies that if you take out a personal loan for 10,000 rupees and pay it back after a week, 20% interest will be added to the original amount of 10,000 rupees. In other words, the $10,000 is still due today. Instead of paying the whole amount due, you are paying them an interest fee.

Since you are now in their hands, there is little you can do to respond to this action against that online personal loan application. You are completely enslaved to them as a result of them having previously taken all of your contact lists, gallery data, and private images like family photographs, according to independent investigation. The firm will absolutely ruin privacy if you give anything back.

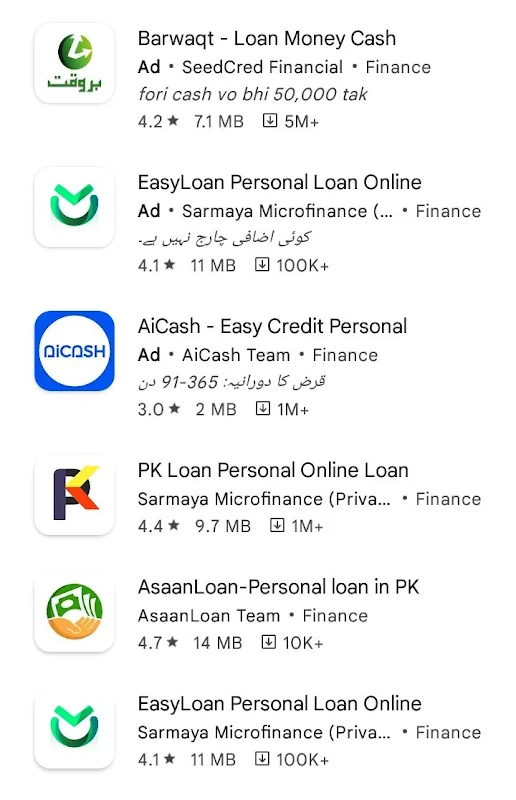

LIST OF THE ONLINE INSTANT LOAN SCAM APPS IN PAKISTAN:-

- EasyLoan Personal Loan Online

- Fori Qarz Online Personal Loan

- PK Loan Personal Online Loan

- AsaanLoan-Personal loan in PK

- AiCash – Easy Credit Personal

- Barwaqt – Loan Money Cash

- RapidCredit

- FORI MONEY-credit loan

- Golden Rupiye

BEWARE OF INDIA’S FAKE INSTANT LOAN APPS

- UPA LOAN

- SAMAY RUPEE

- MINUTE CASH

- 66 CASH

- GOLDMAN PAYBACK

- LEND MALLW

- BUS RUPEE

- KOKO LOAN

- HANDY LOAN

- SILVER POCKET

- OB CASH LOAN

- LOAN RESOURCE(DISI)

- RUPEEKING

- BHARAT CASH

- ONSTREAM

- CASH HOLE

- MI RUPE

- MONEY MASTER

- KASH LOAN SMALL LOAN

- EASY BORROW CASH LOAN

- ONE LOAN CASH ANY TIME

- EASY LOAN

- IND LOAN

- EXPRESS LOAN LOAN DREAM

- WARN RUPEE

- RUPIYA BUS

- WALLET PAYEE

- SMART COIN

- INSTA MONEY

- CASH GURU APP

- RUPEE LOAN FLASH LOAN MOBILE

- LUCKY WALLET

- SLICE PAY

- GOLD CASH

- UPO LOAN.COM

- LOAN CUBE

- ORANGE LOAN

- RUPEE STAR

- BUDDY LOAN

- I KARZA

- ANGEL LOAN

- WOW RUPEE

- CASH MINE

- MONEY STAND PRO

- LOAN SATHI

- CASH PARK LOAN

- TYTO CASH

- POKEMONEY

- SHARP LOAN

- HOO CASH

- MY CASH LOAN

- QUALITY CASH

- DAILY LOAN

- FIRST CASH

- SIMPLE LOAN

- LOAN LOJI

- SKY LOAN

- CLEAR LOAN

- CASH MACHINE LOAN

- FORPAY APP

- MO CASH

- RUPEE BOX

- FOR PAY

- RUPEEPLUS

- JO CASH

- SMALL LOAN

- MINUTE CASH

- DREAM LOAN

- BEST PAISA

- RICH

- FAST PAISA

- CASH STAR MINISO RUPEE

- HELLO RUPEE

- LOAN GO

- MORE CASH

- CASHPAL

- HOLIDAY MOBILE LOAN

- ASAN LOAN

- CASH BOOK

- FORTUNE NOW

- PHONE PAY

- LIVE CASH

- HAND CASH FRIENDLY

- CREDIT WALLET

- PLUMP WALLET

- FAST RUPEE

- LOAN

- POCKET BANK

- CASHCARRY LOAN APP

- LOAN FORTUNE

- BELLONO LOAN

- LOANZONE FAST COIN

- CRAZY CASH

- CASH POCKET

- KOKO LOAN

- QUICK LOAN APP

- INSTA LOAN

- RELIABLE RUPEE CASH

- STAR LOAN EASY CREDIT

- ROCKET LOAN

- APNA PAISA

- EARLY CREDIT APP

- RUPEE MAGIC

- COIN RUPEE

- EAGLE CASH LOAN APP

- ATD LONE

- RUSH LOAN

- CASH ADVANCE

- CASH CARRY APP

- TREE LONE

- BELLONO LOAN APP

- CASH PAPA

- CASH PARK

- BALANCE LONE

- AGILE LOAN APP

- LOAN CUBE

- RICH CASH

- CASH BOWL

- CASH ADVANCE 1

- HAND CASH

- FRESH LOAN

- CASH CURRY

- INCOME

- LOAN HOME SMALL

- BETWINNER BETTING

- CASH MACHINE

- I CREDIT

- RUPEE MALL

- CASH POCKET LIVE CASH

- WEN CREDIT

- SUN CASH

- CASH COLA

AFTER PAYING OFF A DEBT IN FULL, A CASE OF BLACKMAIL WAS FILED IN INDIA.

There was a recent case in the Indian state of Hiryana where it was alleged that a corporation was making threats and demanding money even though the initial loan obtained via rapid online lending applications had already been repaid.

Even though the Panchkula debt was fully repaid, a case of extortion on the side of the lending business has surfaced. In response to the victim’s father’s complaint, the police have opened an investigation at Sector 14 police station. Vijay Kumar, a resident of Sector-17, said to the police in the complaint that his son Mohit Garg had obtained 7000 loans using the Get Cash app in June 2022, all of which were returned. After that, dad began making unreasonable demands of the son’s money. He also threatened to be linked to a fabricated case at the same time.

HOW SHOULD LEGAL ACTIONS AGAINST PERSONAL LOAN APPLICATIONS BE HANDLED?

Pakistan has a dedicated division (FIA) for handling cybercrimes. It is a kind of cybercrime as well. In Pakistan, the FIA is in charge of all online problems including internet fraud. The FIA will settle for both of you even if you decide to pursue legal action against that firm. However, they won’t take any harsh measures on the company. The government only pays FIA salaries for their work; they are not paid to help the general people.

HOW CAN YOU PROTECT YOURSELF FROM SCAM APPS ON THE GOOGLE PLAY STORE?

Google is always working to make the world a better place for people. Google has made it easier for users to report any app they see on the Google Play store. All you have to do is go to the Google Play Store, input the name of the programme that has conned you, click the flag in the top bar, choose the app’s category, and then report it. If the app violates the community or publisher rules, Google will attempt to investigate it and delete it.